What Olink Proteomics does

Olink Proteomics (“Olink”) helps scientists to better understand diseases by studying proteins, which play a key role in how human bodies function and how diseases develop. The company developed a unique technology called “Proximity Extension Assay”, which allows researchers to measure thousands of proteins in a single test, using only a tiny sample. Olink sells testing kits and laboratory services to universities, pharmaceutical companies and medical researchers.

Why we invested

- Proteomics is an important tool for studying diseases, providing crucial insights into their molecular mechanisms; as a result, proteomics is a large and growing market – estimated to be c. $1 billion in 2023 and expected to grow more than 10% per annum.

- Olink’s technology was well proven and validated in the market by a large number of pharmaceutical companies and leading academic institutions.

- Before the 2019 investment, the company’s unique market position had already delivered strong, profitable growth with revenue growing at a 111% cumulative annual growth rate from 2016 to 2018.

- Summa Equity’s expertise in both this specialised part of the healthcare sector and in professionalising fast-growing companies would benefit Olink, particularly given the stage of the investment.

Value creation

- Took Olink from niche player to global leader in proteomics, which now offers a leading technological solution for protein analysis in human protein biomarker research.

- Delivered strong top-line revenue performance over the holding period (c. 40% cumulative annual growth rate from 2018 to 2023), despite a challenging macroeconomic backdrop.

- Grew the company’s customer base from approximately 300 at entry to over 1,000 clients today.

- Won multiple key accounts, with 19 out of 20 top biopharma in the world now being Olink customers, along with most of the world’s largest biobanks.

- Launched new product platforms that today constitute the vast majority of revenue and have the potential to enable future diagnostics solutions.

- Bought and integrated complementary businesses and accelerated research and development (“R&D”) and product launches.

Outcome

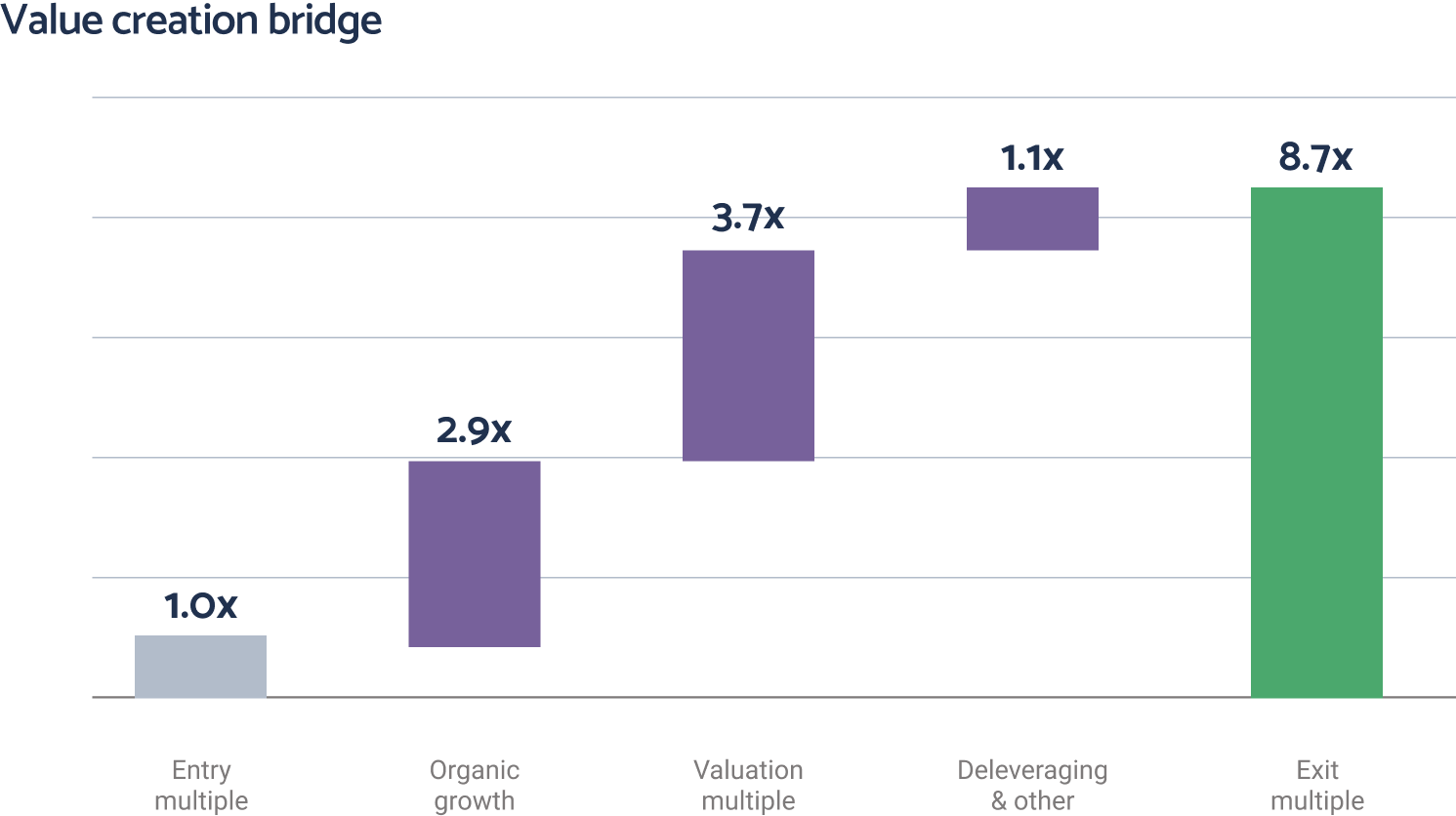

Summa Equity and Pantheon International sold Olink to Thermo Fisher Scientific, generating an 8.7x return on the original cost, with a net IRR of 62%.

About the company

IRIS Software Group (“IRIS”) is a UK-based global provider of business-critical software solutions and services. Founded over 45 years ago, IRIS initially focused on accountancy software and has since expanded its offerings to serve more than 100,000 customers across 135 countries.

The company provides integrated software solutions that help organisations manage core business operations efficiently. Their products are used by professionals in accountancy, education, payroll, HR, and finance to solve essential operational problems, ensuring compliance, reducing administrative time, and generating actionable data insights for better decision-making.

Investment rationale

- At the time of the investment, IRIS had a strong market position in the accountancy, payroll, HR, and education software markets.

- IRIS had an established recurring revenue model with a high level of revenues coming from subscriptions, driven by consistent regulatory updates and additional features.

- High customer retention rates, with approximately 90% gross revenue retention and more than 90% recurring revenues.

- Opportunities for both organic growth and acquisition-led consolidation in the sector.

Our relationship

Pantheon has a long-established relationship with Hg Capital. It has made several primary and secondary investments in various Hg Capital funds and has also completed multiple co-investments alongside the manager.

Active management and value creation

- IRIS has achieved a compound annual growth rate (CAGR) of approximately 18% in both revenue and EBITDA in the five-year financial period ended 30 April 2024, driven by organic growth and strategic acquisitions.

- The company expanded its presence in North America, which now accounts for over 25% of group revenues.

- IRIS made several acquisitions, including Taxfiler, AccountantsWorld, Practice Engine and Dext Software enhancing its product portfolio and market reach.

- The company’s valuation more than doubled from £1.3bn in 2018 to approximately £3.2bn in December 2023.

- IRIS continued to grow its customer base, serving over 100,000 customers globally and processing six million payslips worldwide each month.

Exit

Hg Capital made a partial sale of IRIS Software Group to Leonard Green & Partners (LGP), a US-based private equity firm which specialises in leveraged buyouts and growth capital investments. PIP made a return of 2.7x on the original cost and an internal rate of return (“IRR”) of 19%.

About the company

Arnott Industries (“Arnott”), founded in 1989, is a global leader in the engineering and manufacturing of aftermarket replacement air suspension products and accessories for passenger vehicles. Headquartered in Florida, the company offers a comprehensive range of products, including air struts, air springs, compressors and conversion kits.

Arnott’s products improve the ride quality of a range of cars and trucks, including vehicles manufactured by Audi, BMW, Cadillac, Mercedes-Benz and Porsche.

Arnott is known for its commitment to quality and innovation, serving the automotive aftermarket with reliable and high-performance solutions.

Investment rationale

- At the time of investment, Arnott Industries had a robust and scalable business model with substantial untapped growth potential.

- Arnott’s strong competitive position in aftermarket air suspension products provided a strong foundation for future growth.

- There was the potential to create value through accelerated new product launches, geographic expansion, and accretive add-on acquisitions.

- The partnership with Arnott’s founder, Adam Arnott, and CEO, Joe Santangelo, was central to the success of this investment.

Our relationship

Pantheon has a long-established relationship with Calera Capital, having previously invested in two secondary deals in their funds. Pantheon subsequently made a primary investment into Calera Capital Partners V.

Active management and value creation

- Over the course of the investment period, Arnott expanded its operations to serve customers in over 50 countries.

- Arnott grew its core product line to over 800 offerings, all while continuing to provide a quality service to its key distribution and installer partners.

- Company revenue more than doubled during PIP’s ownership, with double-digit organic growth rates and the completion of four highly strategic and accretive add-on acquisitions.

Exit

- In November 2024, Arnott was acquired by MidOcean Partners, a US-based private equity manager specialising in middle-market private equity, structured capital and alternative credit investments. PIP made a return of 2.7x on the original cost and an internal rate of return (“IRR”) of 15%.

.

About the company

GuidePoint Security is a US-based global provider of consulting services to the public sector and commercial markets, focusing on management, technology and risk consulting.

The company is headquartered in Washington D.C. and employs more than 17,000 professionals in more than 55 locations globally. GuidePoint Security is led by seasoned professionals with proven and diverse expertise in traditional and emerging technologies, markets, and agenda-setting issues driving national and global economies.

Investment rationale

- Complexity of the cybersecurity landscape is becoming more pronounced, with ever-evolving threats and thousands of products available to customers. Therefore, demand for cybersecurity services from organisations is set to grow.

- GuidePoint Security had the potential to scale rapidly via a buy-and-build strategy and organic growth.

- The business had a team of highly experienced cybersecurity practitioners and consultants with deep domain knowledge and expertise. They had developed a best practice approach to evaluating, selecting, implementing, managing and optimising cybersecurity solutions.

Private equity manager profile

- ABS Capital Partners (“ABS Capital”) provides growth equity capital to business-to-business (“B2B”) software and tech-enabled services businesses. The businesses are typically underpinned by strong technology and data and are looking to scale up with the right partners.

- The private equity manager has over 30 years of investment experience and has invested in approximately 130 companies across eight funds.

Our relationship

Pantheon has a long-established relationship with ABS Capital. It has made several primary and secondary investments in various ABS Capital funds and has also previously co-invested alongside the manager.

Active management and value creation

- ABS Capital accelerated the growth trajectory of GuidePoint Security by focusing on its organic growth and geographic expansion. This has broadened the client base across the USA and positioned it for international expansion. GuidePoint Security has more than 3,800 client organisations across the USA, including one third of the Fortune 50 and 40% of the Fortune 500, along with more than half of the US government cabinet-level agencies.

- ABS Capital joined GuidePoint Security’s board of directors. This has brought additional expertise and strategic guidance to the company.

- ABS Capital also recruited top executives with experience in building and leading finance teams for high-growth technology companies.

- ABS Capital has supported GuidePoint Security’s commitment to hiring top cybersecurity talent and investing in innovative service offerings to address new and emerging risks.

Exit

- In October 2023, GuidePoint received another round of funding from Audax Private Equity, a middle market investment firm. PIP took the opportunity to partially exit the investment at a money multiple of 5.7x and an internal rate of return (“IRR”) of 74%.

.

About the company

Based in Poland, Velvet CARE is a major producer and distributor of branded paper tissue products, including toilet paper, facial tissues, kitchen towels, moist wipes, cosmetic pads and buds. It employs more than 850 people across offices and manufacturing facilities in Poland and the Czech Republic.

The company owns the iconic Velvet CARE brand in Poland, which has a 20-year history and a brand recognition of 97% in the country.

Investment rationale

- Abris Capital Partners (“Abris”) has a strong track record in the tissue manufacturing sector. Through its prior investment in a jumbo roll paper producer in the region, and the evaluation of potential add-on acquisitions, Abris has developed significant insights and sector knowledge in the space.

- Velvet CARE is a non-discretionary consumer staples business, where industry growth is driven by the increase of tissue consumption per capita in the Central and Eastern Europe (CEE) region, as well as product innovations.

- At the time of the investment, Velvet CARE was considered to benefit from a number of competitive advantages: strong brand awareness; private label growth opportunities; and margin improvement potential following recent capital expenditure investment for the installation of a new jumbo roll machine.

- In addition, Abris identified upside potential from a possible merger with upstream and downstream value chain players, including those that were already identified by Velvet CARE’s management team, thus offering the potential to create a regional leader.

Our relationship

Pantheon has a long-established relationship with Abris, having invested in the two most recent funds through both primary and secondary investments. Pantheon is also an LPAC1 member in both funds.

1Limited Partner Advisory Committee.

Active management and value creation

- During Abris’ investment holding period, Velvet CARE sales increased by 2.3 times and the company’s EBITDA grew by seven times.

- Velvet CARE expanded its export business fivefold.

- In 2020, the company completed the add-on acquisition of Moracell, the largest manufacturer of paper hygiene products in the Czech Republic. This consolidated Velvet’s presence in the CEE market, strengthened the company’s position as a regional leader, and expanded its international footprint with limited client overlap.

- More than EUR 130m was spent on production, automation and storage capital expenditure to improve competitive positioning across all product categories. In addition, this improved profitability and product quality.

- Following the development and implementation of a comprehensive Environmental, Social and Governance (“ESG”) programme Velvet CARE received B Corp certification in 2023, demonstrating the highest standards of social and environmental performance.

- The company also received a gold medal from EcoVadis, an independent sustainability rating agency.

Exit

Velvet CARE was acquired by a fund managed by Partners Group in December 2023. PIP achieved a gross IRR of 30% and net multiple of invested capital (MOIC) of 4.1x

About the company

Perspective is a wealth and investment manager with 143 advisers providing coverage of the UK market through a network of 40 local offices.

Headquartered in Chorley, United Kingdom, the business provides financial advisory services in the areas of retirement planning, asset management, personal wealth and corporate planning for customers in the United Kingdom.

Investment rationale

- The financial advisory market in the UK is highly fragmented. CBPE saw the potential to consolidate the market through Perspective.

- The business had strong foundations from which to launch a buy-and-build strategy. With a strong compliance culture, client and adviser churn was low. The team was highly experienced and well-aligned with CBPE on strategy. The business had experience of undertaking M&A but had only recently started its M&A journey.

- CBPE and the team recognised the opportunity to build a diversified wealth manager of scale through acquisitive growth of the long tail of relatively small Independent Financial Adviser (“IFA”) firms. Many of these IFAs were approaching retirement and did not have the resources to invest in new technology and compliance systems.

- CBPE partnered with Perspective’s management team, who all reinvested in the business, therefore ensuring a strong alignment of business objectives.

- CBPE understood the key element of a successful wealth business and the importance of maintaining Perspective’s client-centric culture, which reduced compliance risks and ensured client retention and growth.

Private equity manager profile

- Founded in 1984, CBPE is a London-based private equity investment firm that specialises in investing in small and middle-market companies in the UK. The firm has a particular focus on acquiring businesses from founders and management teams in sectors such as healthcare, business and financial services, industrials and technology.

- Since becoming an independent business in 2008, CBPE has raised three funds and has over £1bn in assets under management.

- CBPE works very closely with the management teams of its portfolio companies to drive growth, and is adept at implementing buy-and-build strategies. Since 2008, CBPE has completed more than180 investments, demonstrating its active role in the market.

Our relationship

- Pantheon has a long-established relationship with CBPE. It is a primary investor in several funds, and a secondary investor in CBPE IX and has also previously co-invested alongside the manager.

Active management and value creation

- During CBPE’s investment, the business grew significantly from £2.6bn to £8.0bn of assets under management through a focused buy-and-build investment strategy, supported by strong organic growth.

- Together with Perspective, CBPE built a highly efficient M&A execution and integration team, which allowed Perspective to become the go-to acquirer for retiring Independent Financial Adviser businesses. Perspective has completed over 50 acquisitions since CBPE invested in it.

- CBPE facilitated significant investments in central support functions and technology. This enabled all acquisitions to benefit from consistently high standards of advice and compliance.

Exit

- In February 2024, Perspective agreed a sale to Charlesbank Capital Partners, a US middle-market private equity firm. The transaction closed in May 2024. PIP made a return of 5.4x on the original cost.

About the company

Vistra is a global provider of corporate and trust services.

BPEA EQT (“BPEA”) first invested in Vistra in 2015, completing a major merger with Orangefield at the time of acquisition.

The combined entity has become the third largest player globally in the corporate and trust services industry and the largest in Asia, with a broadened geographical reach a broadened geographical reach and coverage in 85 locations across 45 jurisdictions, broadly split equally between Asia and Europe.

Investment rationale

- Vistra is an asset-light business with high recurring revenues and strong cash conversion.

- At the time of acquisition, Vistra had a deep track record of acquisitions alongside robust organic growth. There was significant scope for more bolt-on acquisitions and operational improvement opportunities.

- Strong alignment with management team who also took up equity stakes in the new enlarged business.

Our relationship

Pantheon has been a long-term investor with the manager, having backed its funds on a primary and secondary basis since 2005. In addition, Pantheon has been an Advisory Board member for numerous BPEA funds.

Active management and value creation

BPEA first invested in Vistra in 2015, completing a major merger with Orangefield at the time of acquisition. This initial acquisition was followed by 21 additional bolt-ons which added $77m of incremental EBITDA at a blended average multiple of 9x Enterprise Value (EV)/EBITDA, delivering on a planned transformational Mergers and Acquisitions (M&A) strategy.

Through this M&A and organic growth, BPEA expanded Vistra’s geographical reach to the Americas, UK, and Middle East, and restructured its divisions to better service the faster-growing Alternative Investment client base.

As a result, Vistra has grown revenue and EBITDA by over 131% and 172%, respectively since 2015.

Exit

Vistra merged with Tricor in 2023, creating a business with a combined enterprise value of $6.5bn. This transaction gave existing investors, like PIP, the opportunity to exit at an attractive return of 3.4x cost multiple.

About the company

Creative Artists Agency (“CAA”) is a talent and sports agency based in Los Angeles, California.

The agency represents clients in the entertainment, media and sports sectors including thousands of the world’s leading actors, directors, athletes, musical artists and broadcasters.

The company was founded in 1975 and employs more than 3,000 people across 25 countries.

Investment rationale

- This was a compelling opportunity to invest in a top agency platform in a market that offers pure play exposure to the media and entertainment sector.

- CAA has enjoyed strong customer and agent retention historically, and has a track record of net client wins against the competition. The only capex needs of the business are leasehold improvements and IT equipment, which account for less than 2% of revenues.

- The business is asset-light with recurring revenues and strong cash conversion. Furthermore, CAA has a highly diversified and stable revenue mix.

- The company performed resiliently through the COVID-19 pandemic and regained strong momentum following the lifting of restrictions.

Our relationship

TPG was founded in 1993 and is a high-quality US buyout manager with whom Pantheon has a long-standing relationship.

Active management and value creation

- TPG completed a large add-on acquisition to CAA by acquiring ICM Partners in September 2021 for a total consideration of US$750m. The combination of CAA and ICM has created a larger platform with access to a global clientele of artists in film, television, music and other entertainment segments. ICM was the fourth largest talent agency prior to the acquisition, and its industry-leading publishing division complemented CAA’s content-driven motion pictures, television, and podcasting businesses, while the combination created a greater number of opportunities for their clients.

- During TPG’s ownership, the company experienced significant organic growth driven by content proliferation and acquisition of further sports rights. In addition, demand from streaming services such as Netflix, Apple TV+ and Hulu has fuelled CAA’s growth.

Exit

TPG sold CAA to Groupe Artémis, the investment company of the Paris-based Pinault family, which has a portfolio of global luxury brands in arts, fashion, publishing, sports and technology.

- Founded in Paris in 1972, Chequers Capital (“Chequers”) is one of the longest established private equity managers in Europe.

- With over 50 years of experience, Chequers has raised and invested 18 funds since 1972, and has over €2bn under management.

- Chequers has 25 investment professionals across France, Italy and the DACH (Germany/Austria/Switzerland) region, supported by a large eco-system of operating experts.

- A small and mid-market buyout specialist, Chequers targets asset-light industrial and service businesses, often acquired from family owners, and focuses on creating value through driving growth and operational improvements.

- Over the past year, Chequers has succeeded in realising several portfolio companies, despite the general slowdown in the exit environment, resulting in sizeable distributions to PIP, including those from Serma, MTA and Riri.

Serma

- Provider of electronic testing services and solutions, for the aerospace, transportation, energy and telecommunications sectors, based in France.

- Exited to a financial buyer in July 2022:

Proceeds to PIP: £1.6m

IRR: 32%

Return generated: 2.4x

Uplift on exit: 50%

Value creation bridge

MTA

- Manufacturer of heating, ventilation and air conditioning equipment based in Italy.

- Exited to Trane Technologies, a US strategic buyer, in May 2023:

Proceeds to PIP: £1.0m

IRR: 40%

Return generated: 3.2x

Uplift on exit: 56%

Value creation bridge

Riri

- Manufacturer of coated metal accessories such as zips, buttons and buckles for the high-end luxury fashion industry, based in Switzerland.

- Exited to Oerlikon Group, a Swiss strategic buyer, in February 2023:

Proceeds to PIP: £2.1m

IRR: 34%

Return generated: 2.7x

Uplift on exit: 82%

Value creation bridge

About the company

Interactive Investor is the second largest direct-to-consumer online wealth management platform in the UK. It operates an investment and trading platform that provides retail investors with financial information, tools and a trading environment in which they can make investment decisions. This award-winning platform puts customers in control of their financial futures.

Investment rationale

The acquisition provided access to a high-growth direct investment market, a scalable business platform that could be expanded rapidly through acquisitions and a combined technological platform that meets clients’ financial needs at different stages of their lives. The business model has stable and high recurring revenues based on a flat-fee monthly subscription model. J. C. Flowers (“JCF”) acquired the company from a very motivated seller, with a plan to (i) consolidate existing customers across business units (a cross-selling opportunity) and (ii) implement a data/technology transformation (combined with improved pricing/brand management strategy).

Our relationship

Pantheon has been an investor in J. C. Flowers’ funds since 2016 via multiple secondary transactions.

Active management and value creation

- Under JCF’s ownership, interactive investor had a strong track record of acquiring and integrating complementary platforms. Interactive investor completed the acquisitions of TD Direct Investing in 2017, Alliance Trust Savings in 2019, and Share plc in 2020. The latest acquisition was the EQi book of customers, which completed in June 2021.

- In addition, the company was able to execute on their technology transformation initiative, making operations more efficient and driving a market leading user experience. Together, these all translated into high growth via the business’s scalable infrastructure and brand leadership, which JCF helped to cultivate.

- From June 2017 to May 2023, J.C. Flowers grew interactive investor’s assets under administration from approximately c. £21bn to £55bn through a suitable mix of organic growth and strategic M&A. This was the equivalent to an annualised growth rate of c.17% over the six year holding period.

Exit

Interactive Investor was acquired by abrdn plc, a UK-based asset manager, in May 2023.