Olink Proteomics

The company

- Region: Europe

- Sector: Healthcare

- Stage: Small/medium buyout

- Type: Co-Investment

- Fund Vintage: 2019

- Exit Type: Strategic sale

- Highlights:

Private Equity Manager (GP)

Case study

What Olink Proteomics does

Olink Proteomics (“Olink”) helps scientists to better understand diseases by studying proteins, which play a key role in how human bodies function and how diseases develop. The company developed a unique technology called “Proximity Extension Assay”, which allows researchers to measure thousands of proteins in a single test, using only a tiny sample. Olink sells testing kits and laboratory services to universities, pharmaceutical companies and medical researchers.

Why we invested

- Proteomics is an important tool for studying diseases, providing crucial insights into their molecular mechanisms; as a result, proteomics is a large and growing market – estimated to be c. $1 billion in 2023 and expected to grow more than 10% per annum.

- Olink’s technology was well proven and validated in the market by a large number of pharmaceutical companies and leading academic institutions.

- Before the 2019 investment, the company’s unique market position had already delivered strong, profitable growth with revenue growing at a 111% cumulative annual growth rate from 2016 to 2018.

- Summa Equity’s expertise in both this specialised part of the healthcare sector and in professionalising fast-growing companies would benefit Olink, particularly given the stage of the investment.

Value creation

- Took Olink from niche player to global leader in proteomics, which now offers a leading technological solution for protein analysis in human protein biomarker research.

- Delivered strong top-line revenue performance over the holding period (c. 40% cumulative annual growth rate from 2018 to 2023), despite a challenging macroeconomic backdrop.

- Grew the company’s customer base from approximately 300 at entry to over 1,000 clients today.

- Won multiple key accounts, with 19 out of 20 top biopharma in the world now being Olink customers, along with most of the world’s largest biobanks.

- Launched new product platforms that today constitute the vast majority of revenue and have the potential to enable future diagnostics solutions.

- Bought and integrated complementary businesses and accelerated research and development (“R&D”) and product launches.

Outcome

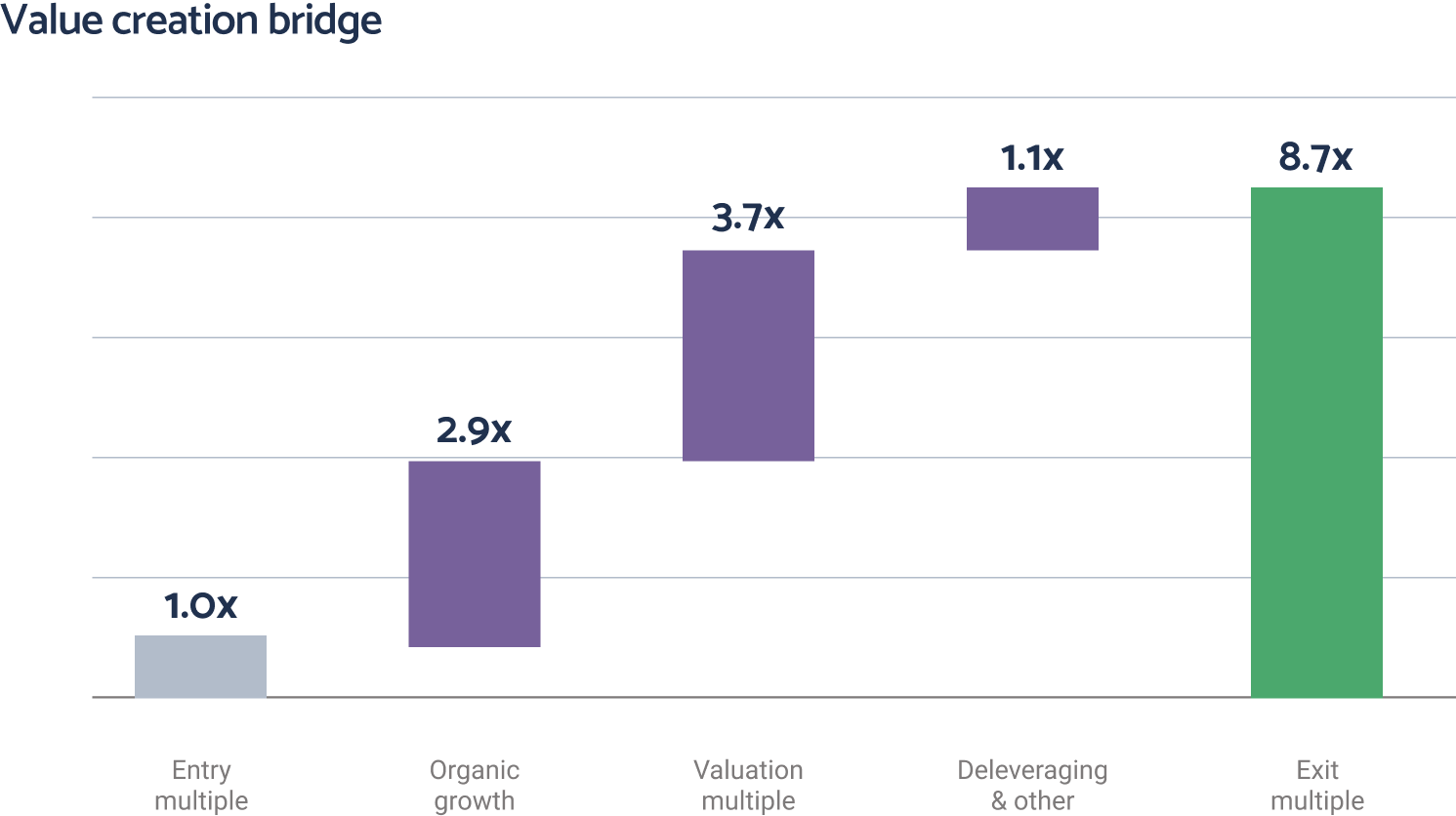

Summa Equity and Pantheon International sold Olink to Thermo Fisher Scientific, generating an 8.7x return on the original cost, with a net IRR of 62%.

You may also like

Our portfolio

Actively managed for our shareholders

PIP's global, diversified portfolio gives exposure to many high quality managers, sectors and companies.

Find out moreOur investment process

Decades of experience, expertise and deep relationships

We have a rigorous and detailed approach to selecting our private equity managers and assessing deals.

Find out more